Recent Tightening of Foreign Exchange Control in China and Its Impact on Chinese FDI Transactions

Friday, January 20th, 2017, 6:29 pmIncreased Governmental Scrutiny

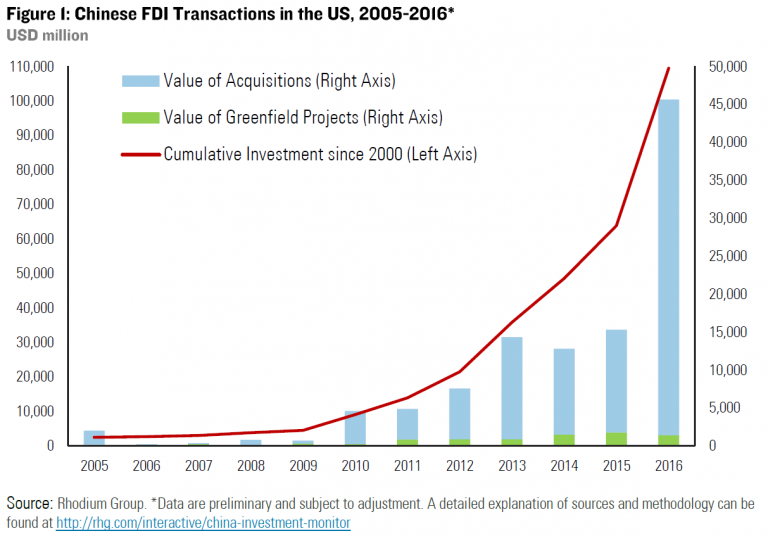

In the past decade or so, the Chinese government has been actively encouraging Chinese businesses to expand globally by acquiring resources, advanced technologies, and distribution channels overseas. Following the relaxation of the outbound investment approval process in late 2014 and early 2015, Chinese direct investment into the U.S. hit a record $45.6 billion in 2016, nearly tripling the amount in 2015 (see figure 1 below), including $36 billion invested by private investors. Despite this surge in the total value of deals in 2016, the total number of completed investment projects by Chinese investors decreased from 169 to 142.

2016 saw a dramatic increase in the average deal value, from $90 million in 2015 to $321 million in 2016. Total investment from the Chinese private companies in the U.S. also increased 202% from 2015 to 2016. Some eye-catching deals included the $6.5 billion acquisition of Strategic Hotels and Resorts, Haier’s $5.4 billion acquisition of GE’s appliance business, the acquisition of Legendary Entertainment for $3.5 billion, Lexmark for $2.5 billion, and Vizio for $2 billion. Some of the transactions involved an unprecedented level of leveraged financing among Chinese buyers.

The strong growth of offshore investment did not come without political risks. The sudden outflow of foreign currency through outbound acquisitions put some pressure on China’s foreign currency reserve, which is closely monitored by the Chinese government with wary eyes. Direct investment in offshore financial products is still tightly restricted. But the depreciation of the RMB and a strong dollar created additional incentive for investors to use the relatively easy outbound strategic investment process as a way to circumvent the currency exchange control.

Starting from the second half of 2016, it has become clear that the Chinese government is poised to tighten its reins on outbound investments. Many investors started to receive interview requests and the filing process to obtain foreign currency slowed down significantly. In a Q&A statement published in late November 2016, the National Development and Reform Commission (“NDRC”), the Ministry of Commerce (“MOFCOM”), the State Administration of Foreign Exchange (“SAFE”), and the People’s Bank of China (“PBOC”) announced that the following types of offshore M&A transactions are subject to additional governmental scrutiny:

Various local government agencies have also implemented rules restricting capital outflow through overseas acquisitions. Although MOFCOM and NDRC, at the national level, have not implemented any formal rules imposing additional restrictions on foreign acquisitions, the recent actions at local level indicate that all overseas acquisitions going forward must meet the following criteria to complete the registration and currency exchange process:

It is generally expected that NDRC and MOFCOM would promulgate formal rules in the near future to provide legal support for case-by-case reviews of outbound investment transactions.

The Chinese government’s plan to stop outbound capital flight has also included increased scrutiny on exchanges of the RMB. Shortly after the joint statement was published, SAFE announced that any exchange of the RMB in the amount over $5 million would be subject to additional review, versus $50 million in the past. Starting July 1, 2017, PBOC, as the regulator of banks, has also required all financial institutions in China to report any cash transactions over 50,000 RMB (approximately $7,200) or overseas transfers over 200,000 RMB (approximately $29,500). All of those measures will make it more difficult for both individuals and companies to exchange RMB into foreign currencies, regardless of the purpose of such exchanges. In the past, individuals and companies did not face too much regulatory supervision and were generally allowed to purchase under $50,000 in foreign currencies for trade purposes and certain personal uses, such as tourism.

Practical Considerations for U.S. Companies Dealing with Chinese Investors

Many U.S. companies with recent experiences working with potential Chinese investors in M&A deals have shared the same frustration. After several months of conference calls either in the early morning or midnight, the parties finally reach agreements on the commercial terms. The deal seems to be going smoothly until all of a sudden, the Chinese investor calls to say that the promised signing or closing has to be delayed due to some new restrictions on currency exchange. Even if there is a binding agreement in place, a seller probably does not have much recourse under the agreement for the change of law, other than waiting patiently for clarity from the Chinese counterpart on the prospect of closing.

Given the recent uncertainties in this area, we will recommend that a potential seller or target consider the following steps after receiving a call from a potential Chinese buyer expressing interest in your company:

Alternative Means to Finance the Deal

Even if you are in the middle of the process without a finishing line in sight, there are other means to finance the deal despite of the recent governmental scrutiny on outbound investments.

Finally, most analysts believe that the current restrictions are temporary. They are merely aimed at preserving China’s foreign currency reserve and discouraging speculative transactions without commercial substance in light of the current economic uncertainties. In the long run, those restrictions could either be modified or lifted when the foreign currency reserve in China or RMB’s exchange rate stabilize.

Ning Zhang

Member

Phone

+16509990227

Fax

+15168218978

nzhang@reidwise.com

Category: Articles